USD/MXN

The US dollar strengthened quite significantly against the Mexican peso over the past week, but has given back some of the gains. All things being equal, I think we continue to have a significant focus on the MXN 21 level, which is an area that, if broken above, could open up a huge move higher. I think at this point it’s very likely that we’ll continue to go back and forth, with more or less of a “buy on the dip” type attitude. If we break below the MXN 20 level, then we could see more of a deeper correction.

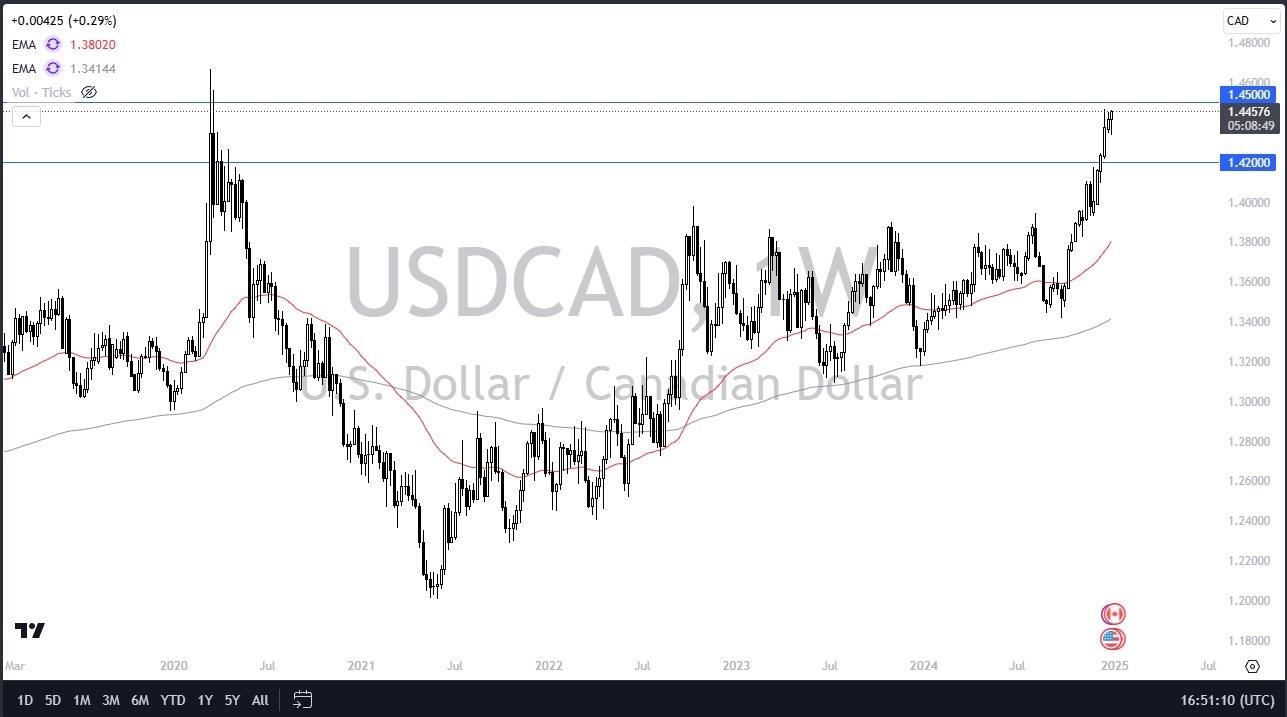

USD/CAD

The US dollar initially fell against the Canadian dollar during the week, but turned around and showed signs of significant strength. Thus, the market looks like it will continue to see more “buying on the dip” as market participants continue to pay close attention to the 1.45 level. If we manage to climb higher, then it is likely that the market will continue to rise, perhaps breaking through a huge resistance. Between now and that move, I predict we will see the occasional pullback to take profits. I also believe there are plenty of buyers willing to get involved.

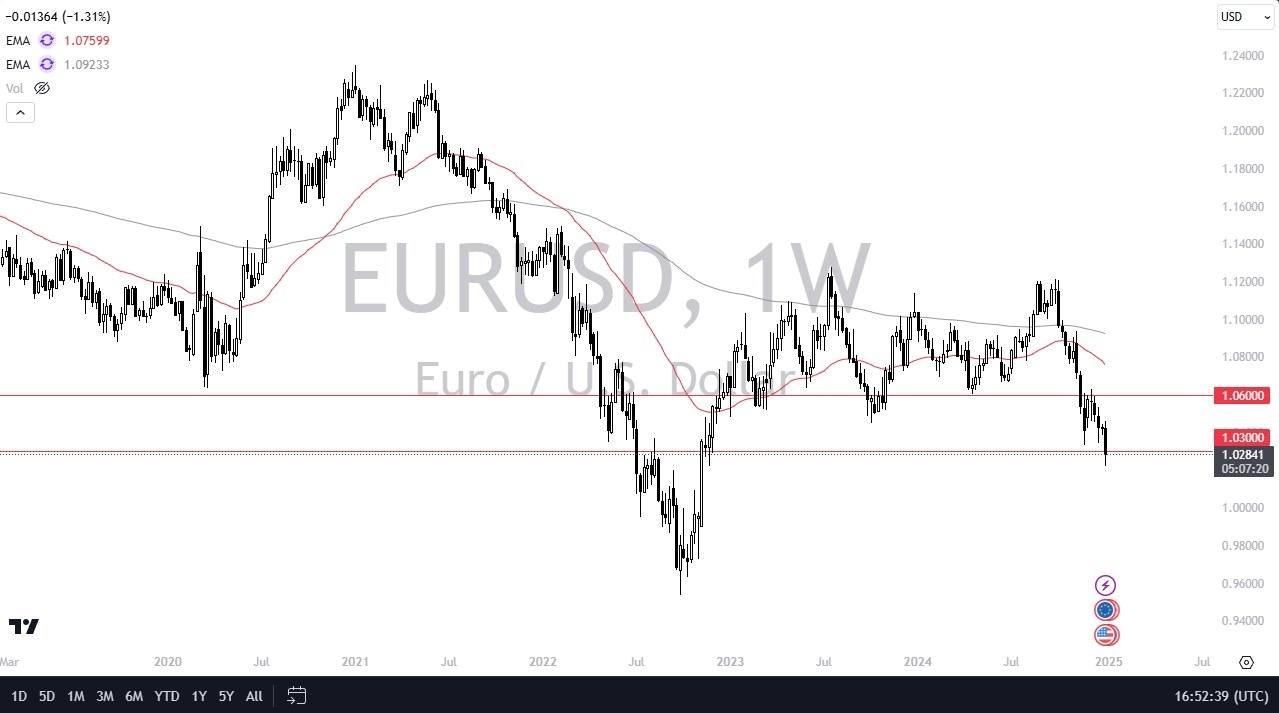

EUR/USD

The Euro initially tried to recover during the week, but then fell apart as we broke below the 1.03 level. The 1.03 level is, of course, a large, round, psychologically significant figure and an area that was previously very supportive. The fact that we broke that level suggests to me that we will continue to go lower. All things being equal, I like the idea that short-term rallies that are showing signs of exhaustion are being fueled, and I think the euro will eventually move towards parity.

GBP/USD

The British pound broke through the week and finally broke below the 1.25 level. The 1.25 level is, of course, an area that a lot of people will be paying close attention to, because now that we’re below it, there’s a chance for this market to go lower. That being said, I think the short-term rallies are probably selling opportunities, but I would also point out that the British pound has outperformed many of its peers against the US dollar, so I think the downside here will be a little less drastic than in other major currency pairs denominated in USD.

USD/JPY

The U.S. dollar has taken a bit of a beating against the Japanese yen over the past week, but frankly, this is a situation where traders are still willing to jump in and pick up any dollar “value” on offer that they can get their hands on. The ¥155 level below remains the main support level, while the ¥158 level above ends up being a huge barrier. If we manage to break above the ¥158 level, then the US dollar is likely to bounce back and go in search of the recent high near the ¥161.50 level.

NASDAQ 100

The NASDAQ 100 has been a bit noisy, but it really looks like a market at this point that continues to be more or less a “buy on dips” scenario. The 21,000 level is an area that many people are eyeing as potential support, but if we were to break below the low of the week, this would be an area that could trigger a bit more selling. At that point, I would expect the NASDAQ 100 to go looking for the 20,000 level for a significant amount of support based on a big, round, psychologically meaningful number, and of course the fact that it was important before. However, all things being equal, I expect this market to be more bullish for most of the week as we come out with the non-farm payrolls data on Friday. Either way, I’m bullish on the long term.

Gold

The gold markets went back and forth during the trading week, which makes sense considering we’re just killing time trying to sort out where we’re headed for the long term. I think we’re getting into a pretty big area of consolidation, because we originally shot straight into the air, and so I think you have a situation where we have to do some of the foam. I am very neutral on the gold market right now, but I realize that any pullback will probably look at the $2500 level as “value”.

DAX

Germany’s DAX was fairly quiet during the trading week, which isn’t a huge surprise given that Germany was still operating. This was the same as last week, but I find it interesting that the €19,750 level has offered a significant level in the market over the last 3 weeks. If we can break higher, crossing the level of 20,000 euros, I don’t see any reason why the DAX will go towards the peak at the level of 20,500 euros.

Ready to trade our weekly Forex forecast? We have compiled a list of some of the best regulated forex brokers for you to choose from.