Fundamental analysis and market sentiment

I wrote on the 29thth December that the best trading opportunities for this week were probably:

A weekly loss of 0.79% equals 0.26% per asset.

Last week the market was more active as the Christmas holidays came to an end; a few key takeaways were:

- The US ISM Manufacturing PMI was better than expected, indicating that the US economy is still on the move.

- US Jobless Claims – A Bit Better Than Expected.

- Chinese manufacturing PMI – slightly worse than expected.

Last week saw continued risk-off sentiment, with particular fears over President-elect Trump’s recent tariff threats and slowing growth data in many G20 countries. However, at the end of last week there was a recovery in risk sentiment. However, two members of the US Fed made sharp comments over the weekend that inflation was not yet under control, which could boost the US dollar and weaken US stocks when markets open on Monday.

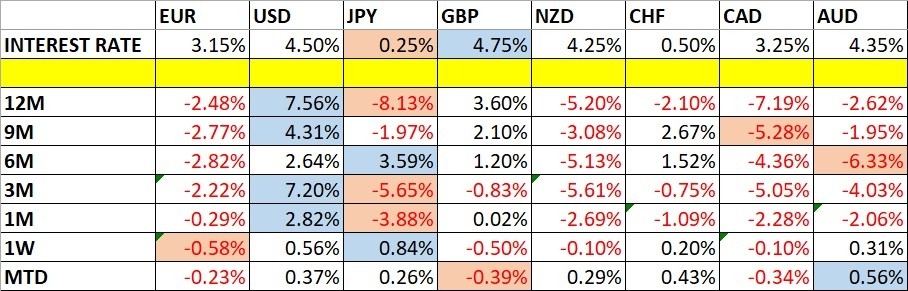

The British pound and the euro are extremely weak in the forex market, while the US dollar and the Japanese yen are strong.

There was little high-impact data last week, but there will be more this week, so markets are likely to be much more active now that the seasonal break is over.

The week ahead: 6th – 10th January

The upcoming week has a much fuller schedule, so it is very likely that we will see increased market activity and volatility.

Important data for the coming week are:

- Average hourly earnings in the US

- Minutes of the US FOMC meeting

- US Non-Farm Payrolls

- US JOLTS Job Openings

- US ISM Services PMI

- German preliminary CPI (inflation)

- Australian CPI (Inflation)

- swiss cpi (inflation)

- US Unemployment Claims

- Unemployment rate in the US

- Canadian unemployment rate

Monday is a public holiday in Italy.

Monthly forecast for January 2025

For the month of December, I predicted that the EUR/USD currency pair would fall in value. The final performance of my forecast was:

For January, I predicted that the currency pair USD/JPY would rise in value and that the currency pair EUR/USD would fall in value

Weekly forecast 5th January 2025

I didn’t make any weekly forecasts last week because there were no unusually strong price movements in currency crosses, which is the basis of my trading strategy.

The Japanese yen was the strongest major currency, while the euro was the weakest. Volatility was much higher last week, with 30% of the most important Forex currency pairs and crosses changing value by more than 1%. It is likely to increase again this week.

You can trade these forecasts on a real or demo Forex broker account.

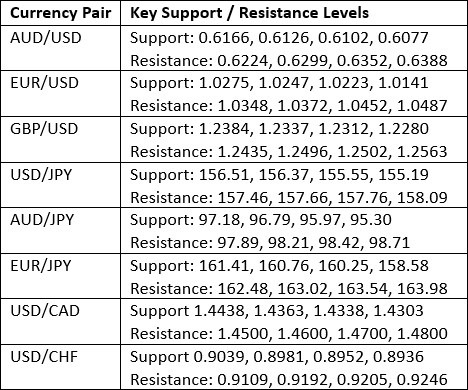

Key support/resistance levels for popular pairs

Technical Analysis

US dollar index

Last week, the US dollar index reprinted a bullish candlestick that continued in a long-term bullish trend, breaking out bullish to achieve its highest close in over 2 years. The price is above the price of three and six months ago, suggesting a healthy long-term bullish trend in the dollar that should be exploited. The breakout was from the inside bar, suggesting momentum could be good. On the other hand, the weekly candlestick has a significant upper wick, indicating that the dollar has already given back some of its gains.

I have many fundamental reasons to be bullish on the US dollar after the Federal Reserve’s sharp hike three weeks ago surprised markets and triggered a rally in the dollar and a sharp sell-off in stocks, while US Treasury yields rose. Comments from two Fed members over the weekend that inflation is still not under control could also generate hawkish sentiment for the dollar and further lift the price, fueling bullish momentum here.

Overall, the dollar is more likely to rise than fall over the coming week. The price has room to rise at least to the next resistance level at 110.00.

EUR/USD

The EUR/USD currency pair is in a valid long-term bearish trend. This currency pair usually takes time to move, with its trends usually involving plenty of deep pullbacks, but nearly three weeks after falling to a new long-term low well below $1.0400, the price has consolidated without definitively turning bearish.

This has changed over the past three weeks, and last week finally saw a further significant breakdown. The euro has weakened sharply, although it is not clear why. The price traded briefly below $1.0225, the lowest price in more than two years.

This currency pair often has very reliable trends, so I’m interested in going short, especially after last week’s crash, which is now trading in “blue skies”.

USD/JPY

The USD/JPY currency pair did not rise last week, although the fact that the entire week was a public holiday in Japan is significant. However, worsening risk sentiment in global markets has prompted the Japanese yen to once again act as a safe haven, and in recent weeks we have seen Japanese monetary policy as a stronger price driver.

I still see this currency pair as a buy, as it tends to trend fairly reliably over the long term, but I have less confidence in this trend than in the bearish trend in EUR/USD as the price here is still well below the relatively recent peak.

Another factor that diminishes my confidence in the bullish trend is that the Bank of Japan will eventually start to implement a more hawkish monetary policy. When this finally actually starts to happen with the next Bank of Japan interest rate hike, it is very likely that the price will start to move downwards, so the trend is sensitive to politics.

USD/CAD

Last week, the USD/CAD currency pair printed another bullish candlestick, closing near its high, but the price fell short of a new two-year high. A look at the weekly chart below shows that the bullish momentum here has been strong since October and the trend here has been stronger and clearer than any other trend in the forex market, which doesn’t happen often in this currency pair as the US and Canadian economies don’t have divergence tendency.

The story is really about US economic success and the Fed hawkishly lifting the dollar, while Canada is currently facing several problems, both financial and political, which are coming to a weaker Loonie.

This currency pair does not move very reliably, so I do not enter into long-term trades in it, but it looks very weak right now. All commodity currencies, except perhaps the Australian dollar, look very weak at the moment, so it might be an idea to use CAD and NZD together as the short component of any Forex trades you take this week, or at least part of the short component by creating a basket. For example, if you were short two lots of EUR/USD, you could also be long one lot of USD/CAD.

Of course, the beginning of January can cause strange and volatile price movements in the forex market that can break trends quickly, so keep an eye on that.

NZD/USD

Last week, the NZD/USD currency pair printed its fifth consecutive bearish candlestick, closing not far from the lows. It closed at a new two-year low, a significant decline in any asset. However, the candlestick was small, indicating that momentum may have slowed, although it was a holiday week, so the market was slow.

This currency pair does not move very reliably, so I do not enter into long-term trades in it, but it looks very weak right now. The Aussie has rallied a bit, but I’ve been talking about the weakness of all commodity currencies, especially the Canadian dollar and the Kiwi, for several weeks now.

Bottom line

I see the best trading opportunities this week as:

- Short of the EUR/USD currency pair.

- Long of the currency pair USD/JPY.

Ready to trade our weekly Forex forecast? Check out our list of the best Forex brokers.