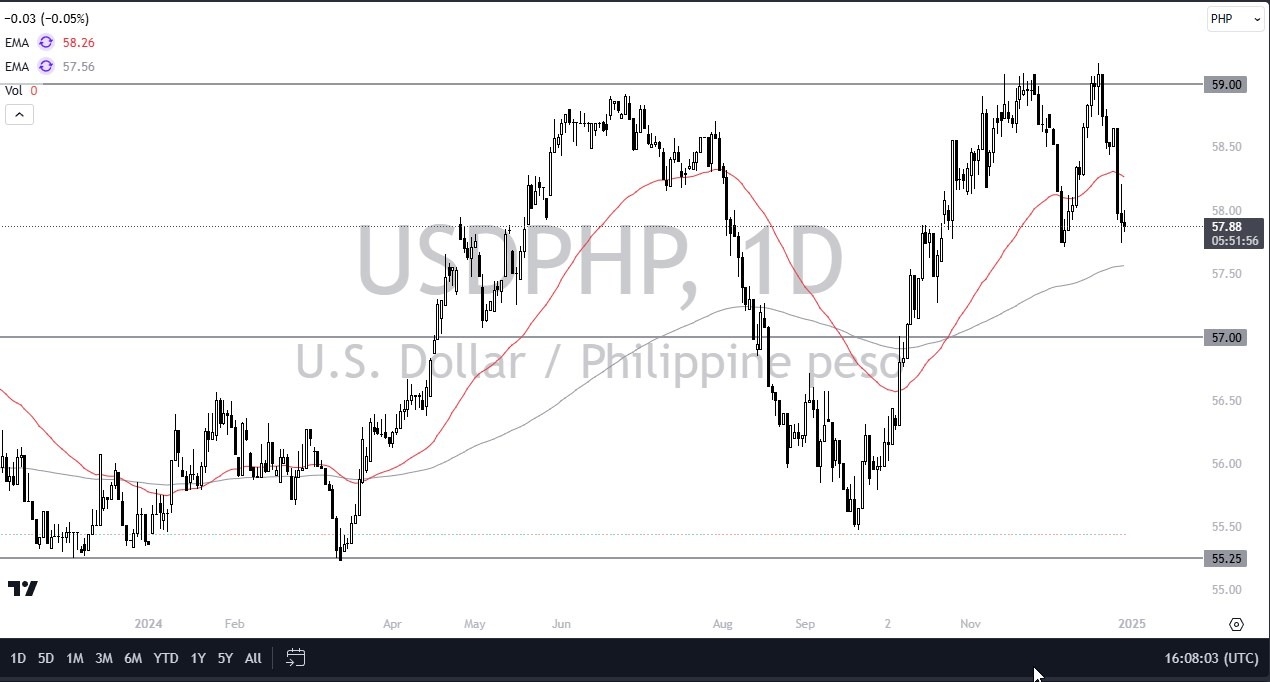

- During my daily analysis of exotic currency pairs, I have been paying close attention to the PHP 57.75 level, as the Philippine peso has strengthened quite nicely against the US dollar over the past 2 weeks.

- However, it should also be noted that the US dollar strengthened quite aggressively to reach this area, forming a bit of a “double top” near the PHP 59 level.

Technical Analysis

Looking at the technical analysis in this market, it is worth noting that we have formed a very irregular candlestick during the trading session on Friday, as we are in an area that could be supportive. We are between the 50-day EMA and the 200-day EMA indicator, and of course that can have an impact. The 200 Day EMA is right around the PHP 57.60 level and rising. I believe it is dynamic support, but I would also start to look at it through the lens of the fact that we are at the very end of the year, and it is of course a fairly small currency pair to begin with. Volume and liquidity would be the main issue at this point.

If we were to break below the 200-day EMA, then it opens up a drop to the PHP 57 level, but on the other hand, if we can break above the 50-day EMA, then the USD will more likely than not go back to 59 PHP level. Anything above that area would obviously be a very bullish turn of events, and then I think the market is probably going to the big, round, psychologically significant PHP 60 level.

Note that the economy in the Philippines has been very strong, but has also been on a downward trend. For example, in the first three quarters of 2024, GDP growth was 5.8%, which was below the government’s target of 6% to 7% for the year. Don’t get me wrong, that’s the kind of growth that would make most countries happy, but it was a miss from expectations, and that could still be somewhat negative for the peso itself.

Ready to trade our Forex daily forecast? Here they are the the best forex brokers in Asia Pacific to choose between.