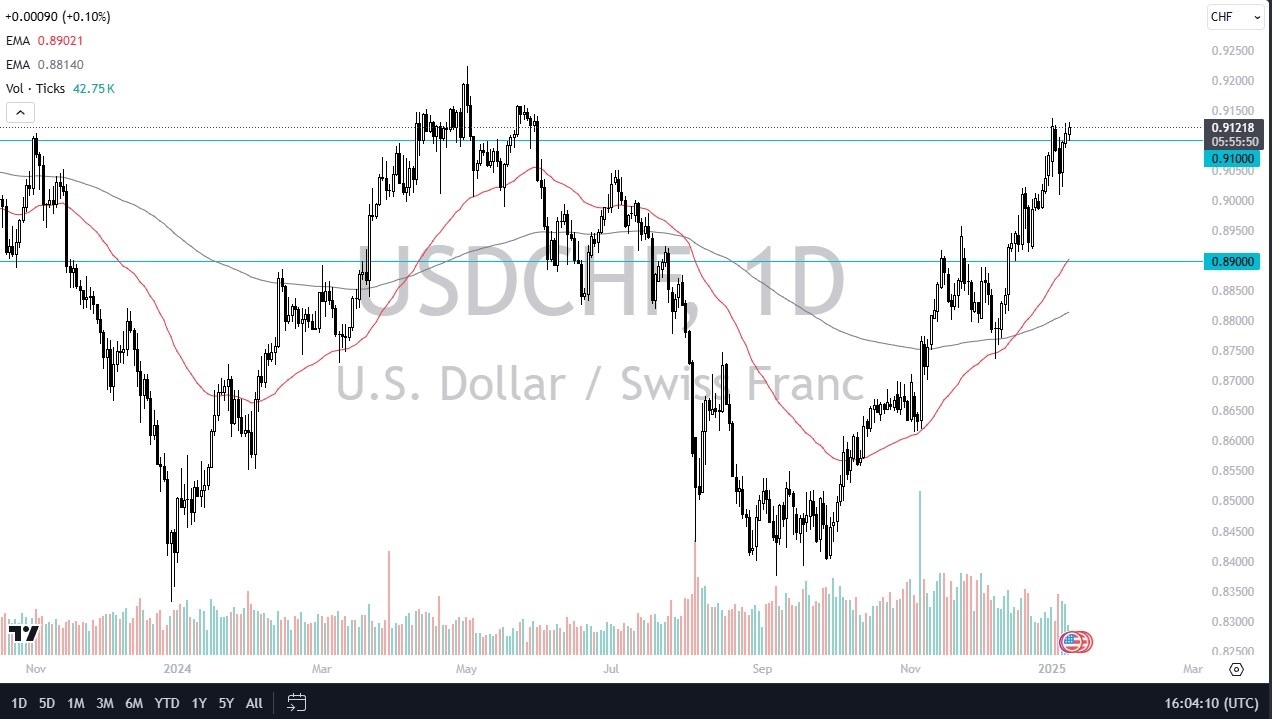

Potential signal:

- I am the only buyer of this pair.

- If we manage to break above 0.92, I will start buying USD/CHF again, with a stop loss at 0.9080.

- The target could be as high as 1.00 in the long term.

During my daily analysis of major currency pairs around the world, USD/CHF is still at the heart of what I watch. Frankly, I think the Swiss Franc is in deep trouble, as the Swiss National Bank cut rates by a whopping 50 basis points when it last made its interest rate decision. This suggests that perhaps there is a bit of fear in Switzerland, and frankly there should be, given the fact that 85% of Swiss exports end up in the European Union. In a sense, this has something to say about the European Union as well, so keep in mind that the whole region seems a bit toxic.

Contrast that with North America

A look at this chart is a complete visual aid as to what is happening in North America in relation to the European continent. While Canada is an absolute mess economically and politically, the reality is that the United States is big enough to take North America down with it. Furthermore, it’s worth noting that there is a lot of concern around interest rates around the world, because frankly, several banks around the world are cutting rates, but in the United States, bond traders don’t seem to care and are simply raising yields. I think that’s probably going to end up being the story here, as interest rates in the United States continue to rise.

That being said, you get paid at the end of every day to own this pair, I think that will be the case going forward. Furthermore, you also have to keep in mind that the Non-Farm Payroll release comes out on Friday, which is a very volatile trading time. However, this is a good potential trading opportunity, and so I watch this chart when the noise comes from the United States.

Ready to trade daily forex forecast? Here they are the best online trading platforms in Switzerland to choose between.