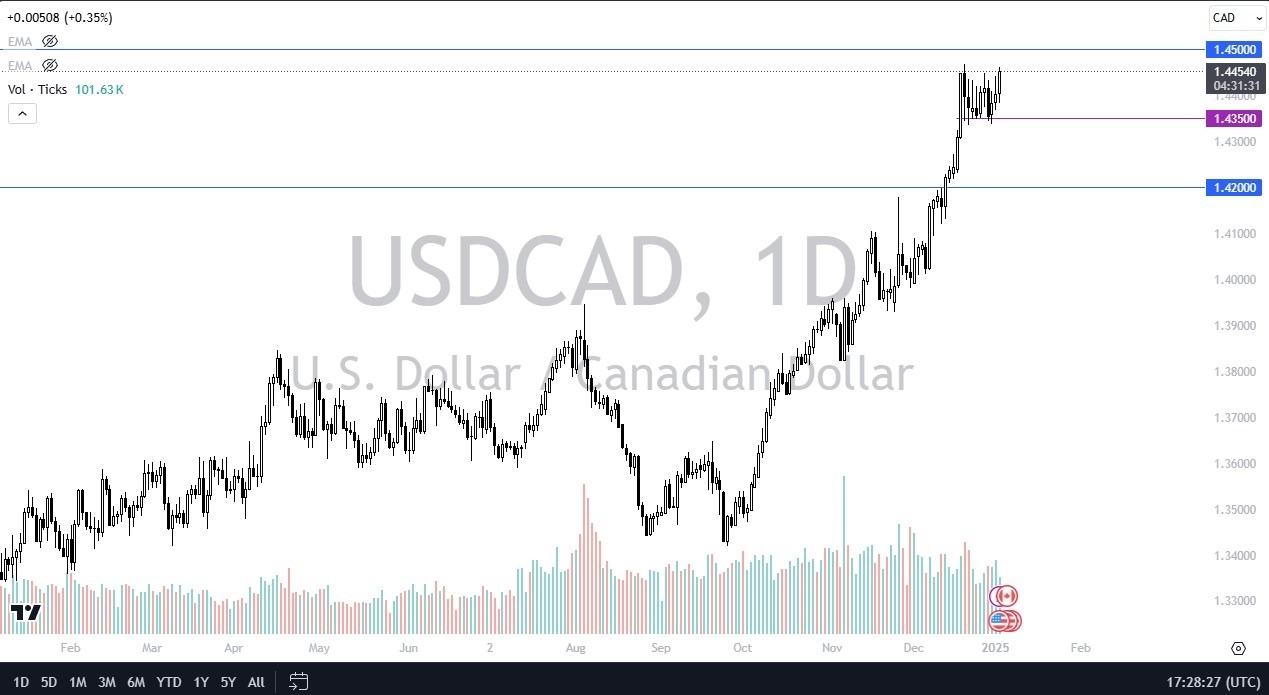

- Another day, another rise in the dollar against the Canadian dollar, but it is worth noting that we are facing a rather serious barrier of resistance in the form of the 1.45 level.

- When you look at the history of this pair, this is an area that has obviously offered tremendous resistance.

- Now, the biggest problem you will have as a retail trader is your tendency to go short immediately.

While it might work, there is no fundamental reason for it to happen. And it is worth noting that we shot straight into the air from about 1.34 to the level of 1.44. This is something that this USD/CAD pair tends to do. They will do nothing for years and then suddenly go in one direction or the other, like 800, 1000 pips.

Canada has more problems

So we’re at the end of this series and now you have to ask what’s next? Well, with the problems in the Canadian government, which are far beyond the scope of this article, it makes sense that the Canadian dollar continues to suffer. But there are some things you can look at graphically. You can see the yield on interest rates in both of these countries, with the US in blue and Canada in red, going in opposite directions. That’s not the end of it, but when you look at this, the Canadian 10-year yield is 3.2 and the US 10-year yield is 4.56.

So if you simply take your Canadian dollars and put them into US dollars, you get a better return and you get currency appreciation. This is one of the main things happening right now. This is a daily line chart, but you can really get detailed if you want.

This is only one piece of the puzzle, but I know many retailers don’t pay attention. In terms of short-term, short-term pullbacks, there are some areas that I would watch. The most obvious would be right around the 1.4350 region – a scenario that has been important several times in the past, so why not again, right? And then after that, you start looking at 1.42. If the market goes back to 1.42, I’m happy because I’ll be buying dollars again. The dollar situation will continue to see strength rather than weakness, despite the fact that it may be a bit overextended at the moment.

Fed funds futures rates are predicting that we will get a quarter basis point, quarter percent, 25 basis point rate cut from the Fed in May. The next one is in December, which means we have a long way to go before the US dollar really takes it in the other direction. Undoubtedly we will have some kind of pullback in the strength of the US dollar.

The question here is, will we get a daily close above 1.45, which would mean the lunatic will still be beaten, or will we pull back a bit and find value? I prefer the latter, but if we break above that 1.45 level, you have to admit it.

Ready to trade ourUSD/CAD Daily Analysis and Forecasts? Here is the listthe best forex trading platform in Canadato choose between.