House agrees to President Trump’s proposal to increase aid to Americans; The US dollar index falls by 0.34%; Economic data in the US is improving.

The US House of Representatives has voted to support President Trump’s proposal to provide additional stimulus payments to needy Americans, a point of contention between the two parties recently. Now the decision rests in the hands of the Republican-controlled Senate, which risks losing its majority in the upcoming Georgia Senate election.

“To reject this would be to deny the economic challenges people face and deny them, again, the relief they need,” House Speaker Nancy Pelosi said.

Next week, Georgians will decide whether they prefer Republicans Kelly Loeffler and David Perdue to hold their Senate seats, or instead support Democrats Raphael Warnock and Jon Ossoff, which would give the Democratic Party control of the House, Senate and presidency for the first time since 2011.

The race is very close, although betting on a Republican victory seems safer at this point. President Trump is ready to campaign ahead of the election.

If Senate Majority Leader Mitch McConnell decides to hold a vote on the stimulus bill, he risks not getting enough votes for additional stimulus, putting the Republican campaign in Georgia in jeopardy. It is a big dilemma for the party, which normally advocates fiscal conservatism, especially since the current situation requires flexibility.

So far, McConnell has not commented on the House decision, although an effort to force Vermont Sen. Bernie Sanders to vote could be successful and force him and his colleagues to take a stand.

The corona virus crisis, even in the midst of the current vaccination campaign, continues to progress in the United States. So far, 19,781,718 cases have been reported, as well as a death toll of 343,182, making the United States the most affected country in the world. Nearly 2 million Americans have already been vaccinated, falling short of the government’s goal of vaccinating 20 million by the end of the year.

Economic calendar

So far this week, no relevant data on the state of the US economy has been released, mainly due to the year-end holiday.

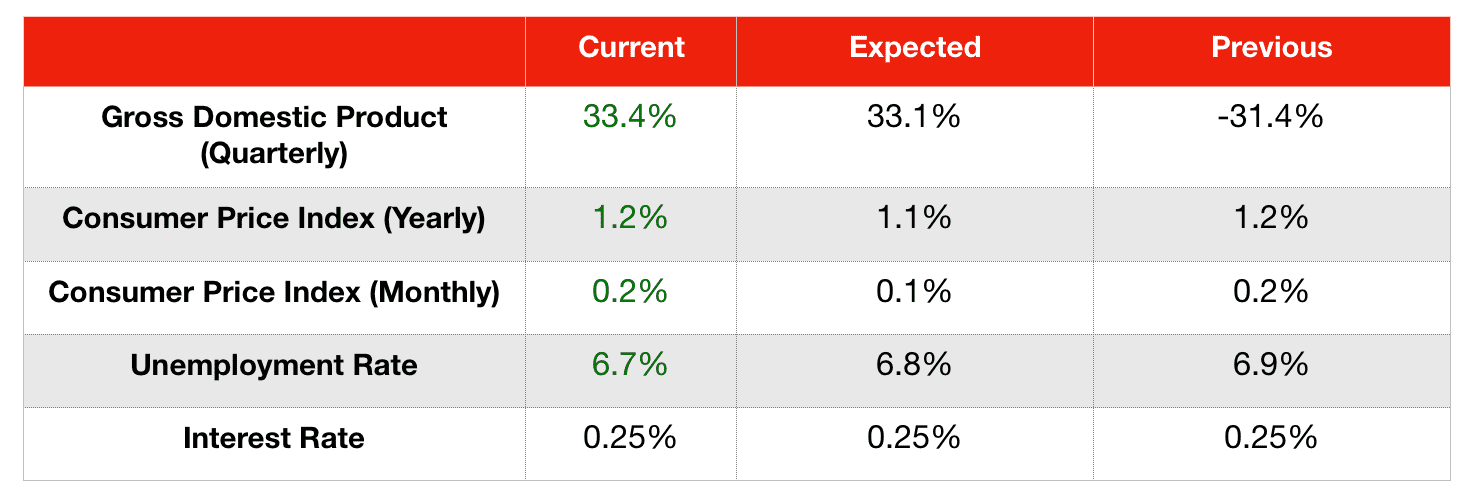

Last week, annual gross domestic product for the third quarter was reported at 33.4 percent, after coming in at 33.1 percent in the previous reading. This is a significant improvement compared to the figure from last quarter, which was -31.4 percent.

The U.S. Census Bureau reported that permanent good orders rose 0.9 percent, more than expected, though lower than October’s 1.8 percent jump. Non-defense capital goods orders rose 0.4 percent, less than expected and below October’s 1.6 percent.

Dollar Languishes

The U.S. dollar index, which measures the greenback’s performance against a range of its major rivals, fell 0.34 percent, giving up its previous gains.

The House’s decision has increased uncertainty about the future of the Republican-controlled Senate as the Georgia runoff approaches. The fact that the US is increasing its deficit strengthens the case for continued dollar depreciation.

“We see the dollar’s depreciation continuing into 2021,” said a team of Goldman Sachs strategists. “Liquidity dynamics and the flow of virus news may affect the timing of dollar weakness, but not necessarily the medium-term downtrend.”

The dollar has been losing strength in recent months. So far this month, the dollar is down 2 percent, posting a loss for the second month in a row as it fell 2.31 percent in November.

US economic data is improving

Since our last report, US economic data has turned slightly better.

The quarterly gross domestic product figure was recently revised upward to a higher-than-expected 33.4 percent, according to data released by the Commerce Department. Consumer spending appears to have led to a recovery in the third quarter, although there are already signs of cooling as retail sales fell in October and November.

CPI data was essentially unchanged since our last report, indicating an improvement in the monetary sphere. In the same way, unemployment data signal an improvement in the labor market.

Upcoming events

This week is New Year’s Eve, so not much relevant data on the state of the US economy is expected to be released.

-

The October S&P/Case-Shiller home price index will be released on Tuesday.

-

Pending home sales data for November will be released on Wednesday.

-

Data on jobless claims will be released on Thursday by the US Department of Labor.