Germany, Great Britain consider further blockade; The Eurozone economy is improving, but worse than expected.

According to Germany’s Federal Statistics Office, retail sales rose 5.6% (yearly) in November, higher than expectations of 3.9% but lower than the previous month’s 8.6% rise. On a month-on-month basis, retail sales rose 1.9% in November, less than October’s 2.6% rise but well ahead of forecasts for a 2% decline.

The Federal Bureau of Statistics linked the expansion to a surge in online sales and home improvement spending.

Retail sales should grow by 4% this year despite the catastrophic effects of the pandemic on economic activity. This is good news for Germany, which is currently struggling with the spread of the virus.

In order to curb the spread of the virus, the German government is considering extending the quarantine by three weeks. Most German states have already agreed to the introduction of the measure, which should be announced on Tuesday after a meeting with Chancellor Angela Merkel.

Since mid-December, schools, shops and services have been closed due to COVID-19, which has infected 1,796,216 people and killed 35,632. With the new measures, the restrictions would end on January 31st instead of January 10th.

Employment snapped a 14-year streak of growth as it fell 1.1% year-on-year, the biggest drop since 1993, according to recently released data. Markit Economics reported a slower expansion in the manufacturing sector in December, as the manufacturing PMI came in at 58.3 after reading 58.6 in the previous month.

German Chancellor Angela Merkel recently concluded a Comprehensive Investment Agreement with China, which would further improve economic relations between the two countries. The decision was made despite the demands of President-elect Joe Biden, as the agreement would make it more difficult to align European Union policy with that of the United States.

Economic calendar

With the New Year holiday, there was no data on the European economy last week.

This week, Markit Economics reported that the European Union’s manufacturing sector expanded less than expected, with a manufacturing PMI reading of 55.2, down from 55.5 the previous month. It was expected to remain unchanged.

Euro Recovers

So far this week, the euro has gained 1.21% against the US dollar, snapping a two-week losing streak. It also managed to rally against the pound, advancing 1.88 percent and snapping a three-week losing streak.

The euro’s recent gains can be linked to the UK’s decision to impose another lockdown due to the uncontrolled spread of the newly identified strain of COVID-19. This autumn has offset sterling’s gains from the post-Brexit trade deal.

“Sterling lost ground against the euro yesterday as the market reacted poorly to the prospect of a third national shutdown in England,” explained Caxton FX analyst. “With Brexit now receding, the economic backdrop will be a more significant driver of the pound today and in the coming months.”

The European Central Bank, now in the midst of a policy review, provided additional stimulus in December, expanding its emergency bond-buying program by 500 billion euros. ECB Governing Council member Pablo Hernandez de Cos called on the Bank’s governing board to explore other options that could help reduce the volume of bond purchases.

“I think yield curve control is an option worth exploring,” commented de Cos. “The experience of these central banks suggests that, if credible enough, yield curve controls allow the central bank to achieve a yield curve configuration with fewer actual purchases, thereby increasing efficiency.”

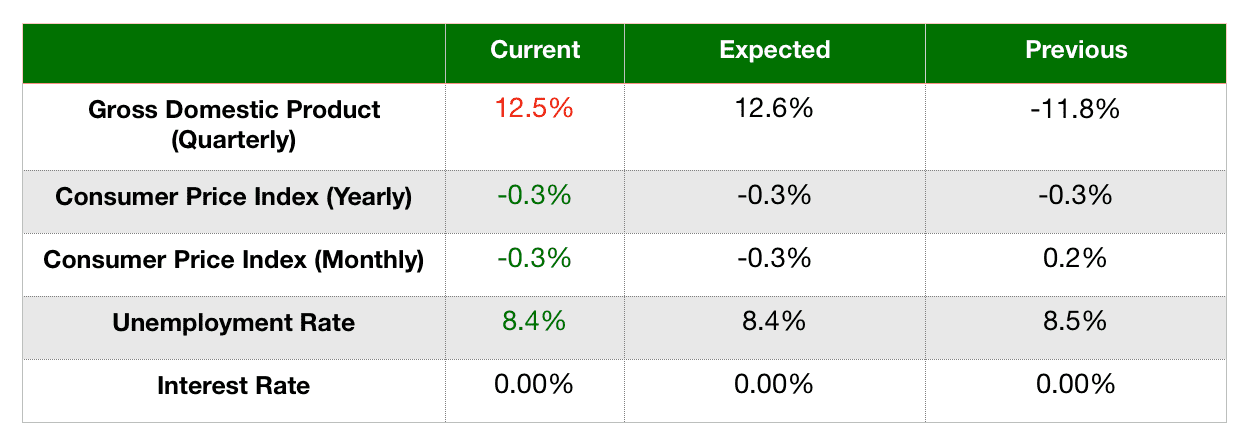

Eurozone economy worse than expected, although improving

Since our last report, Eurozone growth data has remained unchanged. Inflation remained in line with analysts’ expectations, although well below the ECB’s target. The latest unemployment rate signals a slight decline in the labor market at 8.4%, after being at 8.3% in September.

According to a survey of economists conducted by the Financial Times, analysts expect the eurozone economy to recover by 4.3% this year. This figure is in stark contrast to the projection of the International Monetary Fund, which amounted to 5.2%.

As for unemployment, analysts are more pessimistic with forecasts of over 10%, which is significantly higher than the last reading.

Upcoming events

- IHS Markit will release composite and service PMIs for the Eurozone tomorrow.

- The release of retail sales data is expected on Thursday.

- Data on the Consumer Price Index, business climate and confidence in the industry will also be published on Thursday.

- Unemployment data will be published on Friday, November.