- During my daily cryptocurrency analysis, Ethereum caught my attention as it lost over 6%, mainly due to the idea of increasing yields in the United States.

- The exact cause of this, of course, cannot be known with 100% certainty, but it is worth noting that the ISM Services PMI numbers came out worse than expected, as did the JOLTS US job openings number.

- In other words, the US economy is still on fire, which means that cheap and easy money coming from the Federal Reserve is almost a laughable fantasy.

Technical Analysis

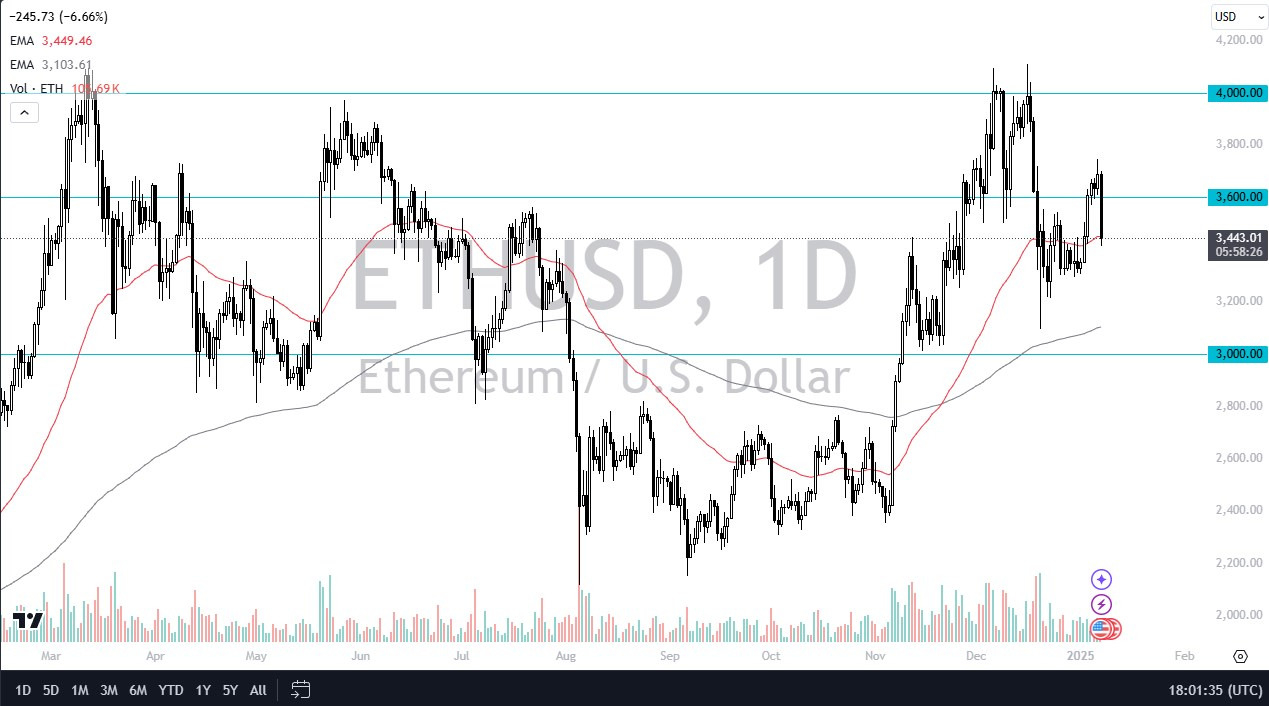

The good news of course is that the Ethereum market still has a lot of support below, not the least of which would be the 50-day EMA, currently sitting at the $3400 level. In fact, we are already starting to see a small recovery from that indicator. If we bounce from here, then it will be interesting to see if the $3750 level breaks to the upside, because if it does, it opens up the possibility of a move to the $4000 level.

However, if we break below the $3300 level, then I think we will be looking at the 200-day EMA, which is right around the $3150 level. Below, we also have the $3000 level, which is a big, round, psychologically meaningful number. Overall, this is a situation where traders continue to find opportunities to buy on dips, and despite the fact that we’ve seen this type of action throughout the day, I think it just means it’s only a matter of time before we see value hunters return to this market .

The size of the candlestick is obviously impressive, but that’s how crypto behaves at times, especially when you get explosive moves in the bond market, because almost all crypto adoption relies on cheap and easy money. That being said, the market will likely continue to experience high volatility, but will bounce back sooner or later.

Ready to trade daily Ethereum forecast? Here they are the the best MT4 crypto brokers to choose between.