Stocks, US dollar fall in anticipation of Democratic victory.

The Democratic Party is likely to win two contested Georgia Senate seats, giving the party the trifecta for the first time since 2009, according to recently released election data. That would allow President-elect Joe Biden to govern without opposition, although Trump’s claims of fraud will be debated in Congress today.

As of this writing and with 98 percent reporting, Democratic candidate Raphael Warnock leads the race against Republican Kelly Loeffler with 50.6 percent of the vote, while his running mate Jon Ossoff currently holds a lead over Republican opponent David Perdue with 50.1 percent .

“We were told that we cannot win this election. But tonight we proved that with hope, hard work and people around us anything is possible,” Warnock said during the Livestream message. “I’m going to the Senate to work for all of Georgia, regardless of who they voted for in this election.”

Warnock would be Georgia’s first black senator, although many are concerned about his record of anti-Semitism and domestic abuse. Ossoff would be the youngest member elected to the position.

Now all eyes are on Congress, which will meet today to ratify the Electoral College results. Trump urged Vice President Mike Pence to deny the certification of certain voters. The certification could take hours, as some senators and representatives plan to challenge the results of certain states, such as Pennsylvania, Wisconsin and Georgia, after evidence of election fraud.

Analysts say Trump’s attempt to overturn the election results is likely to fail, as he would need the support of a majority in Congress, which seems unlikely at this point. Senate Majority Leader Mitch McConnell voiced his disagreement with the president on some key issues, urging senators to ignore Trump’s demands. So far, eleven Republican senators have joined Trump in his claims, as well as more than 100 Republicans in the House of Representatives.

In addition to all this political drama, the United States is still battling the spread of COVID-19, which has infected an estimated 21,579,641 Americans and killed 365,664, making the US the worst-hit country in the world. The US is currently in the midst of a vaccination campaign, which has been heavily criticized for being slow.

Economic calendar

This week will see some important data on the current state of the US economy.

Markit Economics released a manufacturing PMI on Monday, which signaled sector expansion in December with a reading of 57.1, up from November’s 56.5. This is the highest number since September 2014 and is part of an eight-month streak of growth.

“Amid a significant deterioration in supplier performance, cost burdens and selling prices rose as firms sought to partially shift to higher input prices,” IHS Markit reported.

The Institute for Supply Management (ISM) confirmed the data on Tuesday, saying the manufacturing PMI came in at 60.7, higher than expectations of 56.6 and the previous month’s 57.5. “Manufacturing expectations have moderated slightly, however, as the post-election surge has eased and virus cases have rebounded,” IHS Markit added.

Dollar Sinks on Prospect of Democratic Trifecta

Markets don’t seem happy with the idea of a Democratic-controlled Senate, and that’s reflected in the recent performance of the US dollar. Also for this reason, stock markets have been volatile recently.

The main cause of this pessimism appears to be the fact that a Democratic trifecta would make additional fiscal stimulus measures more likely, which is generally bad news for the dollar’s performance.

“The Democrat-led government is expected to add more stimulus to ease the virus crisis and … that means the dollar will be weaker,” commented a BNP Paribas analyst.

Tax increases and further regulations are also among the possible measures affecting the market.

So far this week, the US dollar is down 0.69 percent against a group of its major rivals, extending a two-week losing streak.

The US economy appears solid

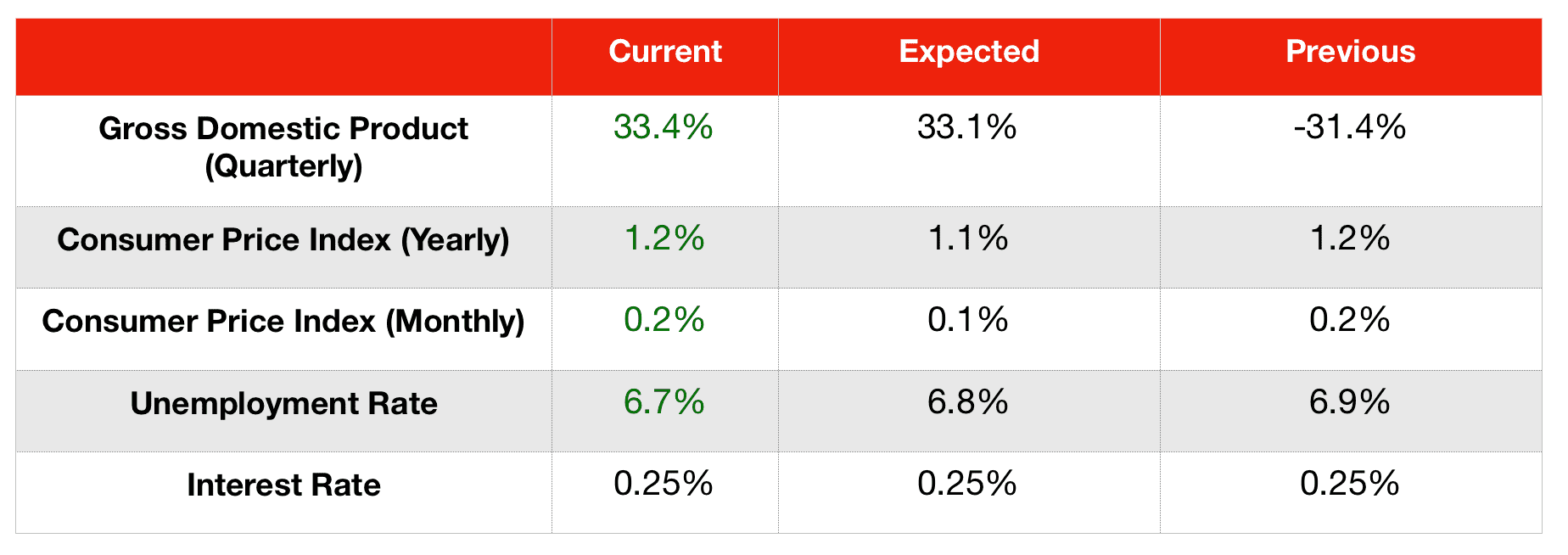

Since our last report, economic data has remained unchanged.

Quarterly gross domestic product is 33.4 percent, which is higher than expected. Inflation data also beat expectations, signaling an improvement in the monetary sphere, while the unemployment rate stood at 6.7 percent, lower than expected.

Upcoming events

-

Today, the Federal Open Market Commission will release the minutes of its latest meeting.

-

On Thursday, the US Department of Labor will release initial and continuous jobless claims data.

-

Also on Thursday, the Institute for Purchasing Management releases PMI services for December.