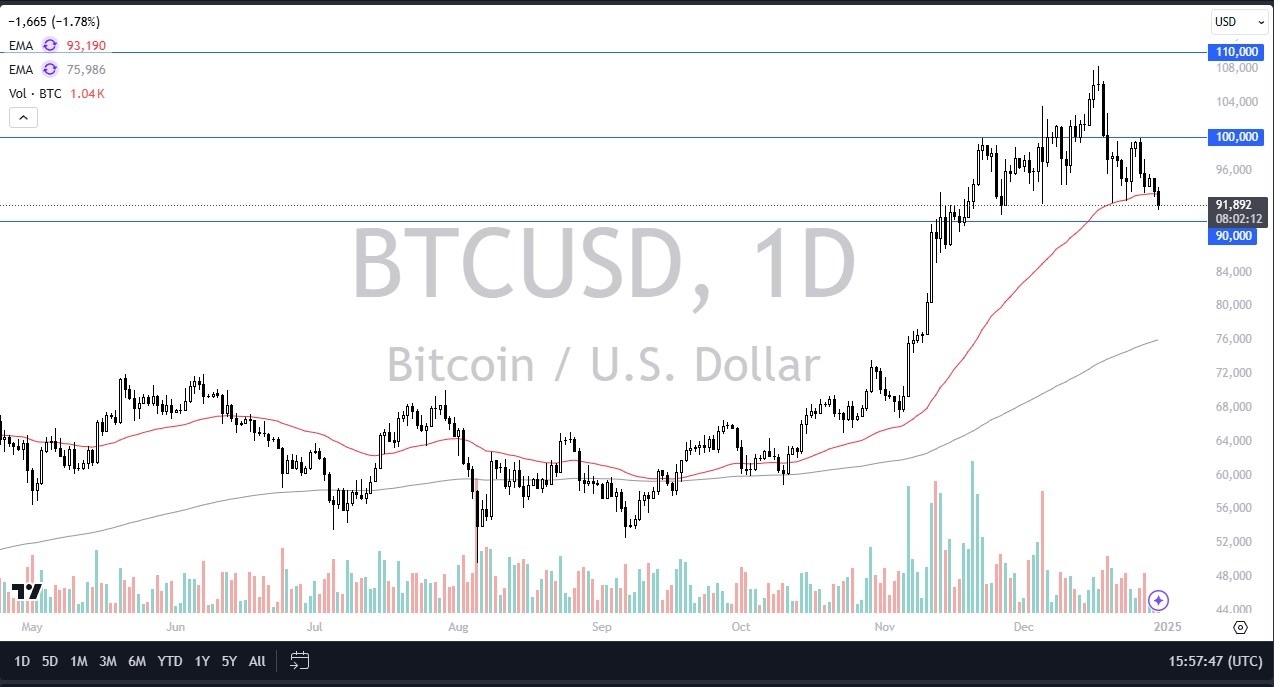

- During my daily analysis of Bitcoin, the first thing I see is that we are actually struggling a bit.

- It’s worth noting that we’ve seen a lot of buzz in this market recently, and perhaps a bit of a “blowback” due to the fact that Bitcoin rallied so fiercely earlier this year.

- Yes, we now have ETFs in full effect, but we also have to remember that professional traders usually don’t chase moves like this, but rather wait for the market to stabilize before putting money into the business.

- So it doesn’t surprise me at all that we’re in the same range we’ve been in for the better part of 6 weeks.

Technical Analysis

The technical analysis for this market is bullish in the long term, but in the short term we are starting to see some sideways action. This makes a certain amount of sense given that market participants continue to view this through the prism of a market that is overpriced, and of course markets that will have to deal with the idea of higher interest rates in the United States. Although most Bitcoin traders do not pay attention to the interest rate markets, they do so at their own peril. Ultimately, institutional traders will be paying close attention to the so-called “risk-free rate,” which is currently at 4.6% or roughly over 10 years. In other words, they prefer not to take risk if they can get a guaranteed return.

Granted, bitcoin is more likely to beat that, but in the short term it’s hard to get overly excited about various risk appetite assets, not just this one. That being the case, I think you should look at this as a market that will eventually sort itself out, but right now we’re still in a scenario where buying on the dip is more likely than not to end up like that in the future.

Ready to Trade Bitcoin Forex Forecast? Here is a list of some of the best crypto brokers for you to check out.