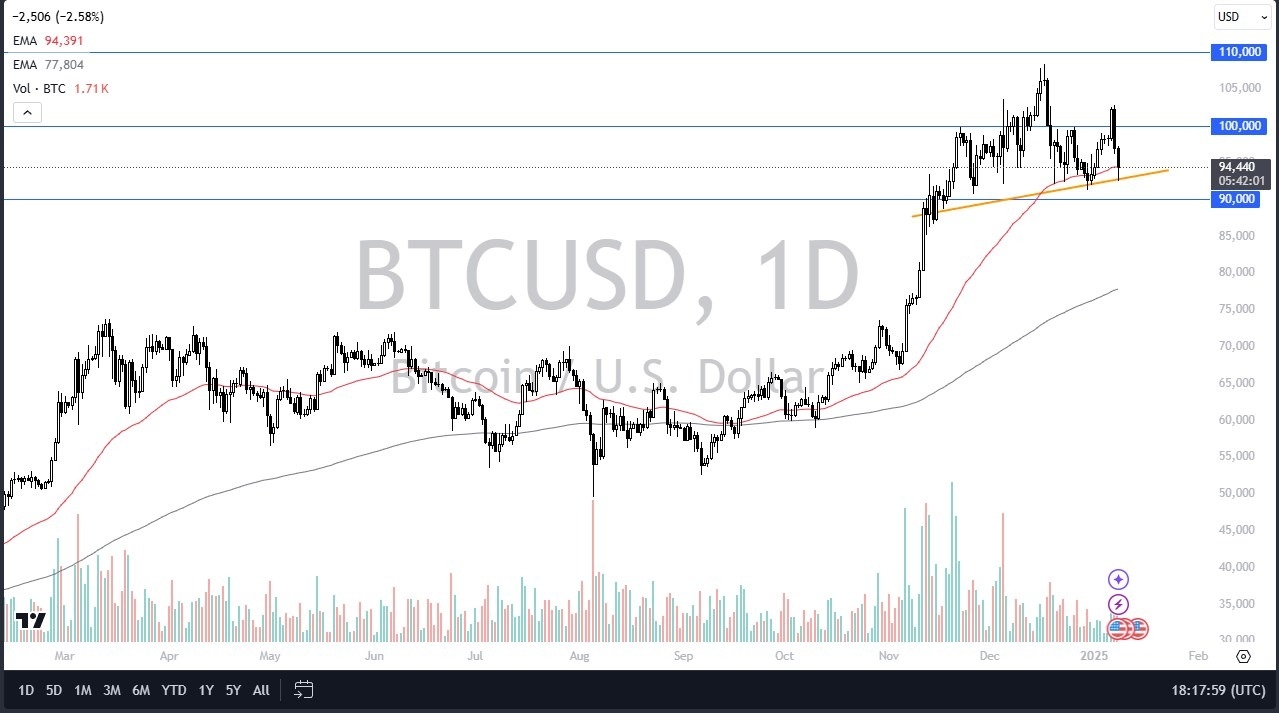

- The Bitcoin market fell slightly during the early hours of Wednesday to break the 50-day EMA and test the short-term uptrend line that was somewhat important.

- But I think more importantly, what we’re paying attention to here is the idea that interest rates in America continue to be the main story.

- Interest rates initially jumped during the day, but have since calmed down and that, of course, is key.

That being the case, I think you have to look at the market through a risk-in or risk-out situation. You also need to understand that Bitcoin does not operate in a vacuum. The overall market sentiment is a little dodgy and nervous, but with yields pulling back a bit later in the day, maybe that could get people trying to buy some. Bitcoin has experienced explosive growth in the last few months, and with that, I think you need to get rid of some of the excess noise and foam that has appeared in the market.

Even if we fall

Even if we were to break below the low of the day, which appears to be a trendline, I think you still have plenty of support near the $90,000 level followed by the $88,000 level. In general, I think you also have to look at this from the perspective that it could be an accumulation phase. At the end of the day, long-term traders still believe in Bitcoin. That hasn’t changed. And they will want to keep owning it. So at this point, most of the bitcoin traders I’ve talked to are actually buying little bits and pieces along the way when it goes on sale. I think we could ultimately look for the $100,000 level, then the $108,000 level, and finally test $110,000 above.

Ready to trade Bitcoin forex forecast? Here‘ a list of some of the the the best crypt brokers to check