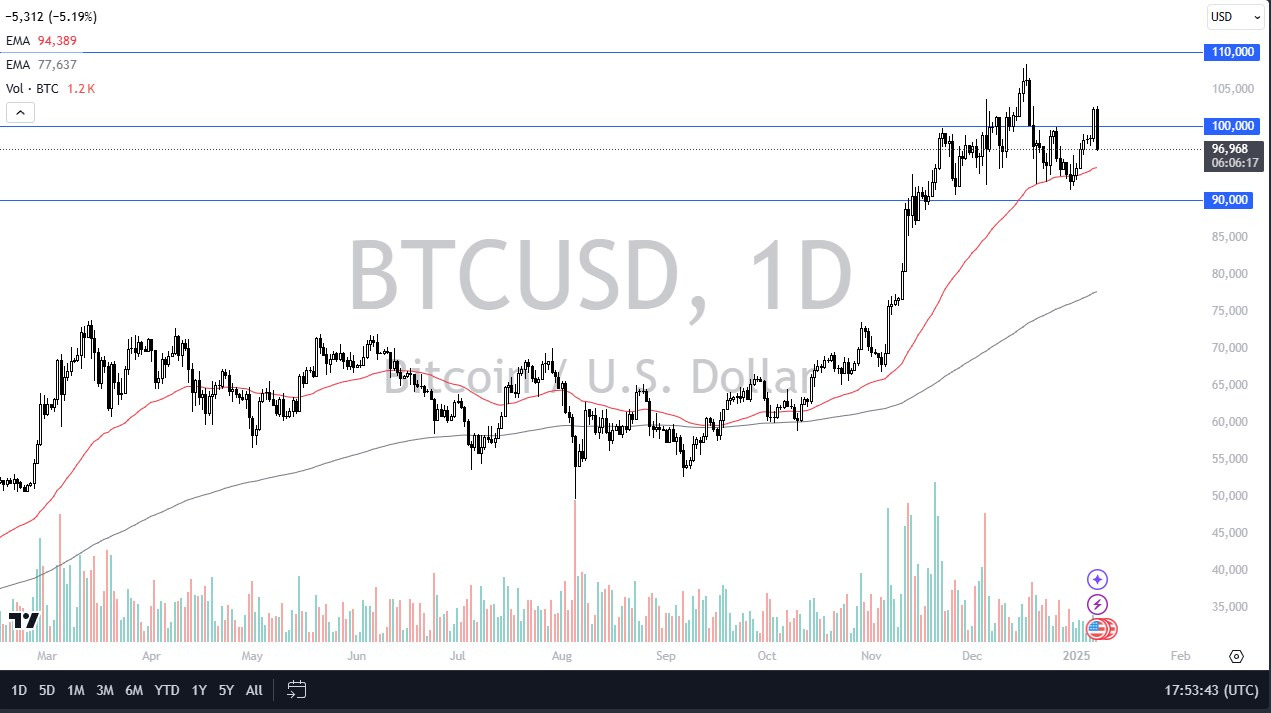

- My daily cryptocurrency analysis obviously starts with Bitcoin, which was completely destroyed during Tuesday’s trading session.

- There are many reasons to think this has happened, but frankly, I think the most obvious is that the 10-year yield has risen again in the United States.

- That said, this big candlestick suggests we might see a bit more trouble, but I don’t know if anything has changed long term.

Consolidation?

I believe we will continue to see a lot of consolidation at this point, and I think it makes some sense given how explosive the Bitcoin price has been in 2024. After all, the market has seen a lot of inflows over the past year, and I guess at this point every time Bitcoin drops a bit, traders are more likely to come in and start buying more. I believe there is a hard floor under here, but of course the question will be where exactly is it?

I think the accumulation is taking place right now, and it’s probably worth noting that the volume is down a bit, and that’s something that leads me to believe that interest has died down a bit in the short term. However, I see significant support in the $90,000 region, assuming we can even get down there. On the upside, I see a lot of noise around the $103,000 level and then again at the $109,000 level. I guess we have a scenario at this point where $110,000 is a big hurdle that will take a lot of work to get over. However, if we were to get further than that, it could open up a huge move to the upside.

This is my base scenario, although I think it will take some time for this to happen. I believe that Bitcoin will continue to grow in the long term, but we have a lot of things to do, one of which, of course, will be waiting to see what the new administration in Washington will do about crypto adoption.

Ready to trade daily Bitcoin forecast? Hereis a list of some of the the the best crypt brokers to check.